Award-winning PDF software

IRS 1040 2025 for Queens New York: What You Should Know

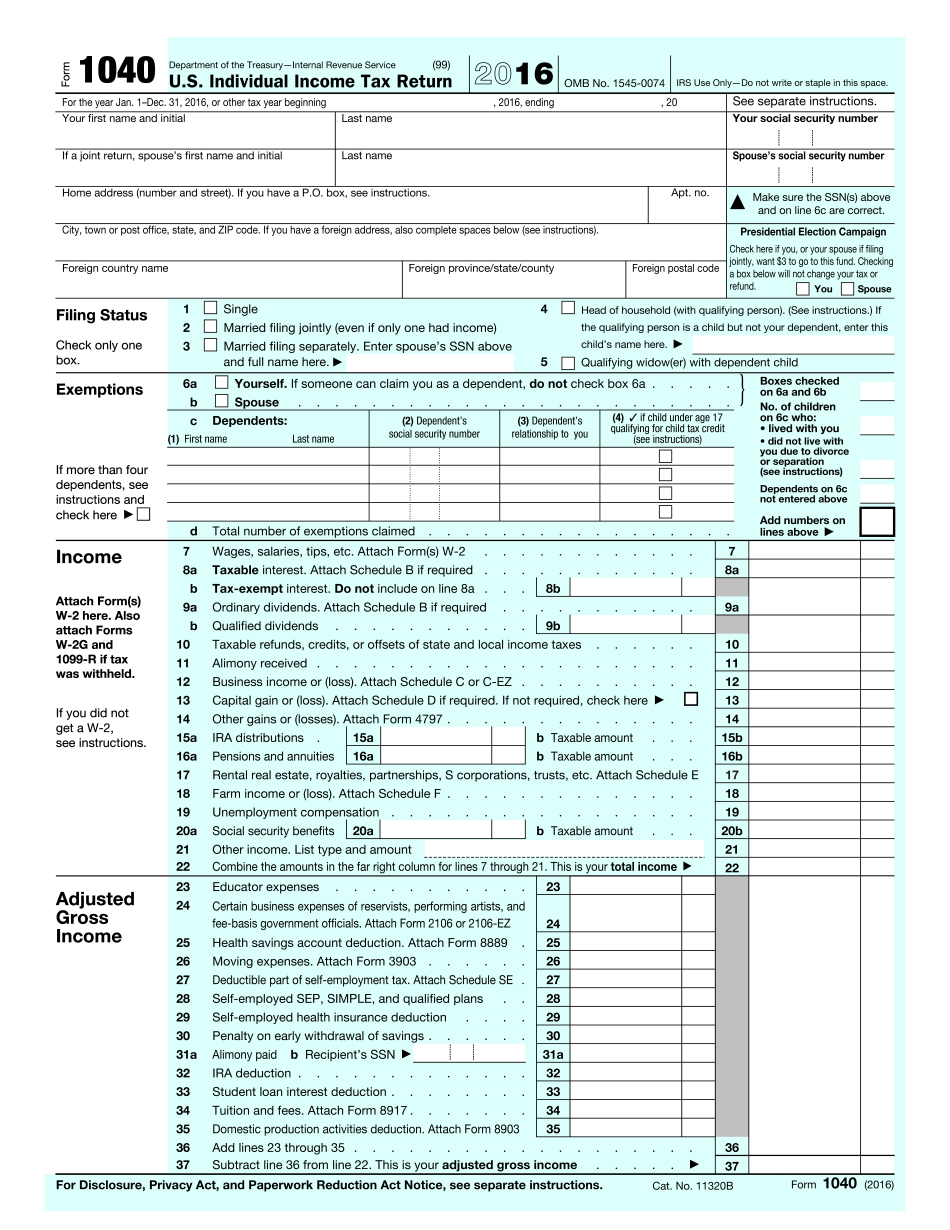

The return is used to report income, add up certain expenses, claim the earned income credit, and file the Internal Revenue Code (IRC) 6498. IRS Announces Tax Relief for New York Victims of The October 16, 2018, deadline applies to the quarterly estimated tax payment, normally due on September 15 and to the quarterly payroll and excise tax returns. The filing due date is normally October 15 for taxpayers with AGI 200,000 or less and December 15 for all others. Where to File Addresses for Taxpayers and Tax Professionals — IRS Oct 16, 2025 — All taxpayers and tax professionals should register for the IRS Electronic Federal Tax Submission System (EFT SS) -- 10-SEPT-2021. By signing up, you will receive a confirmation e-mail in a few days to go back and make additional changes to your return. IRS Offers New Tool to Help Taxpayers Identify and The June 20, 2013, deadline applies to any information requests about tax returns made by the IRS — 10-APR-2022. The request can be made through the E-File website at IRS.gov or by calling. IRS Issues Request For Applications The February 9, 2018, deadline applies to any requests for a tax return (Form 1041) filed outside New York -- 10-MAY-2018. The request can be made through the E-File website at IRS.gov or by calling. IRS Releases Request for Taxpayer Enrollment in New IRS Enrollment Center The March 31, 2018, deadline applies to any applications for enrollment for an E-File account using an E-File PIN. The request can be made through the E-File website at IRS.gov or by calling. IRS Offers To Offer New Taxpayers Assistance On March 9, 2018, the IRS announced it was extending the eligibility period for the Taxpayer Assistance Program (TAP) from 12 months to 18 months for any taxpayer that had been determined ineligible for the TAP Program as of this date. The TAP Program is a service that helps taxpayers with low- and moderate-income tax problems to avoid the burden of a difficult tax situation.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 1040 2025 for Queens New York, keep away from glitches and furnish it inside a timely method:

How to complete a 1040 2025 for Queens New York?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 1040 2025 for Queens New York aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 1040 2025 for Queens New York from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.