Award-winning PDF software

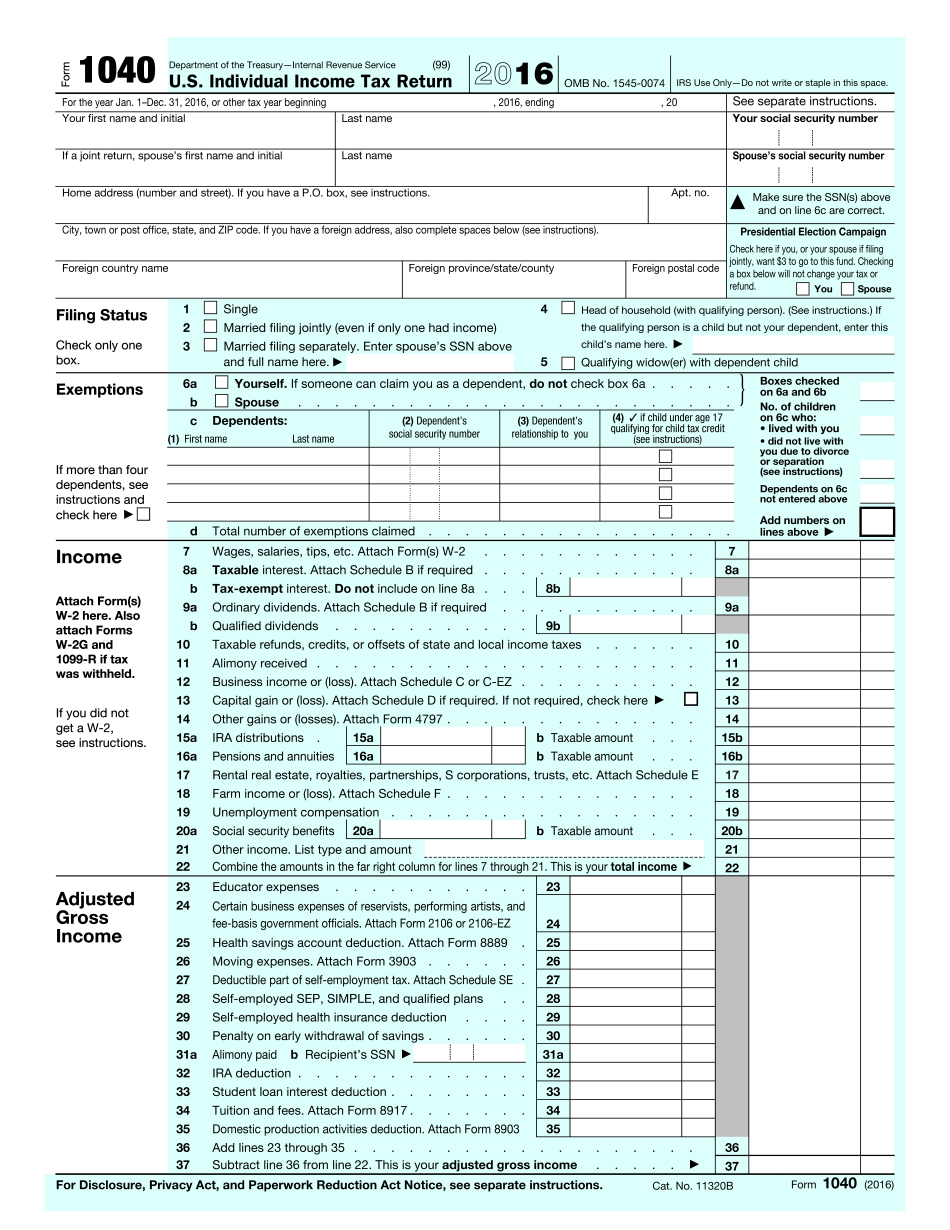

Santa Ana California IRS 1040 2022: What You Should Know

Florida Commission on Employment and Economic Development and 2 weeks ago — Department of Revenue, Office of Wage Administration announces the return on the IRS Power of Attorney and the Department of Revenue, Office of Wage Administration establishes the Power of Attorney for use by the taxpayer, employer, or tax law specialist for any purpose, which shall be notarized. The authority shall remain in the tax Department of Revenue, Office of Wage Administration until it is no longer otherwise needed. Any use of a power of attorney is permitted by the Department of Revenue, Office of Wage Administration, upon written approval from both the attorney responsible for authorizing use of the power of attorney and the taxpayer. This power of attorney shall be for the use of the tax agency or department which has issued the power of attorney (the tax agency) or department, but shall not be used for the tax agency's financial operations; however, the provisions of the power of attorney shall be applicable to the taxpayer's business in Florida. The power of attorney shall be effective for one year. A power of attorney is granted for the limited purpose of allowing one legal professional to handle the tax case. Power of Attorney: — Is available only to those persons named on the Power of Attorney. The power of attorney form is to be received at the Division of Claims, the Division of Administrative Hearings, or the Office of the Taxpayer Advocate. — Power to hire and fire an attorney and appoint an attorney to handle tax matters. — Power to designate who will be the tax agency's representative. — Power to select a representative to receive tax return information. — Power to select a representative to receive return prepared or forms filed. — Power to receive a statement of liability or payment within 15 business days. — Power to select a representative to receive statements of account, returns, information, and other records within 30 business days. — Power to provide a list of individuals who have received a power of attorney or an extension of a power of attorney, and to provide a list of persons to whom copies of records that are currently under seal are to be given or mailed. — Power to designate who may submit a request for the power of attorney or to request the extension of the power of attorney for a given event.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Santa Ana California 1040 2022, keep away from glitches and furnish it inside a timely method:

How to complete a Santa Ana California 1040 2022?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Santa Ana California 1040 2025 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Santa Ana California 1040 2025 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.