Award-winning PDF software

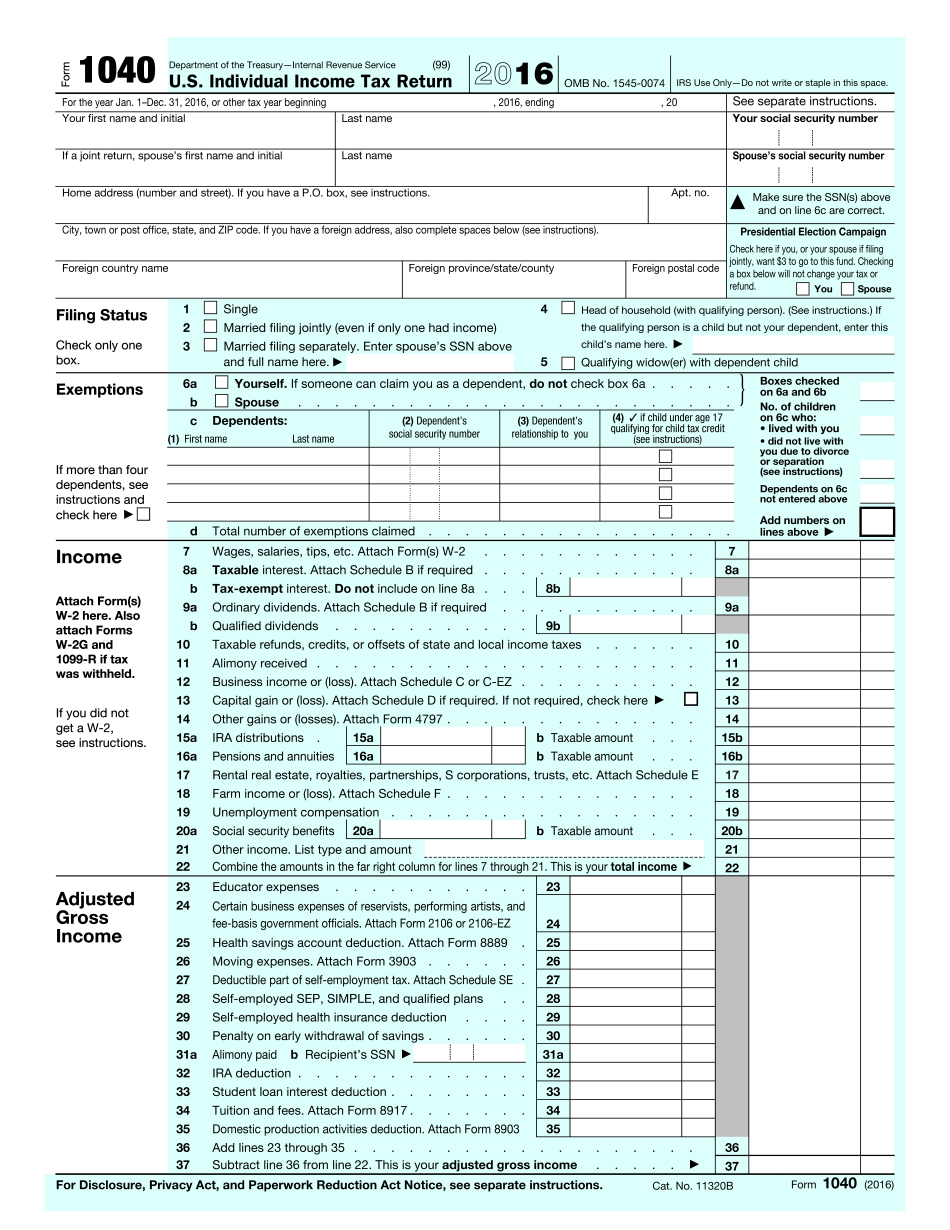

IRS 1040 2025 Sandy Springs Georgia: What You Should Know

Fulton County has adopted a Homestead Exemption Program to ensure its residents the protection of tax exemptions as citizens through income tax-free status. You must have lived in your home in Fulton County for the preceding three years to qualify. You do not need to actually live in your home for the exemption to apply. Your home must meet the following property requirements. The home cannot be the same property as the rental unit. The unit must be owned by you in the same unit as where you file your return. Your home must not be in the same building as a commercial facility or as a part of a business building (including a church or place of worship). Your home must not be operated or maintained directly by you. (See page 3 of the Georgia Property Tax Worksheet for more details on the home.) You must pay or have paid taxes on the home at least one year prior to the filing date of your return. The house and premises must have been continuously used as a home or residence during the three-year period immediately preceding the filing of your return, if you are filing as an individual. Your home must be owned or leased by you. If the property was not your own, then you must have obtained the property through a bona fide sale, gift, bequest, lease, rental, lease transfer or a transfer of title from an individual who is entitled under law, other than this title, to benefit of the exemption. (See the IRS page for additional information.) You must have owned or lived in your home in Fulton County for the three-year period immediately preceding the filing of your return. You must have lived in your home in Fulton County continuously from November 1, 2025 – December 31, 2017, if filing electronically. You must have paid taxes on your homestead at least one year prior to the filing date of your return. For those living on the homestead for at least half-time, Fulton County will waive the property tax. If the exemption is not paid, Fulton County will withhold 20% of the annual property tax for homeownership. There is no property, income limit or age requirement.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 1040 2025 Sandy Springs Georgia, keep away from glitches and furnish it inside a timely method:

How to complete a 1040 2025 Sandy Springs Georgia?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 1040 2025 Sandy Springs Georgia aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 1040 2025 Sandy Springs Georgia from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.