Award-winning PDF software

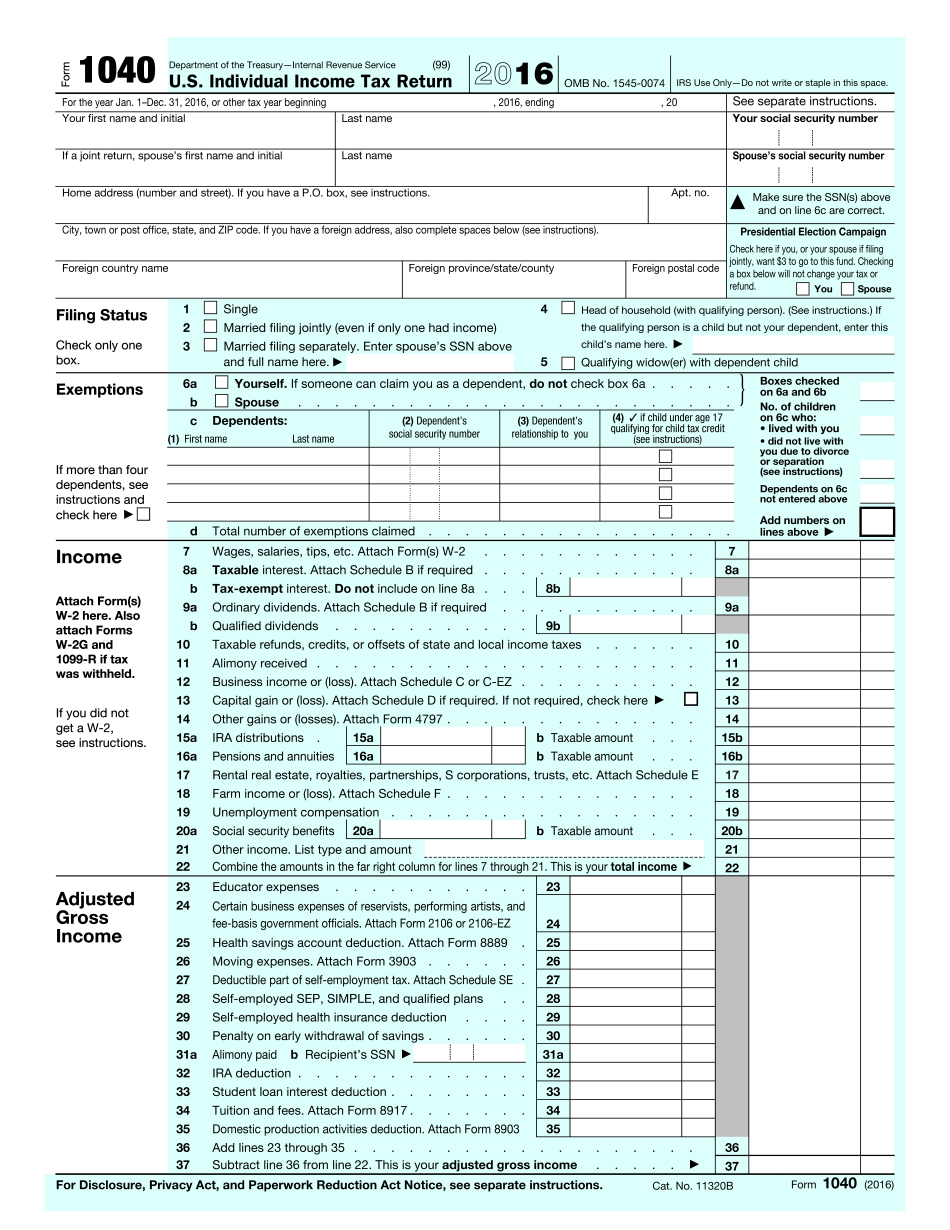

IRS 1040 2025 online Baton Rouge Louisiana: What You Should Know

State Office, 725 Paula Avenue, Baton Rouge, Louisiana 70801;; TaxPrepNow Louisiana, 590 South Claiborne Avenue, Jefferson Parish, Louisiana 70801;; TaxPrepNow Texas, 13500 Highway 99 East Suite 4, Houston, Texas 77; TaxPrepNow, 2109 Memorial Parkway, Bldg. E5-100, Montgomery, Louisiana 70920; TaxPrepNow, 1516 North St. Claude Avenue, New Orleans, Louisiana 70118. Laws of Louisiana does not have an official state book or constitution, but has a code of laws that forms the basis of most statutes, and a common law system that derives much of its authority from that code. It also includes a wide variety of codes issued by other states, and acts of Congress. Louisiana Law on State Tax Issues Louisiana has a complex approach to state tax law. Generally, tax laws are divided into two groups — State specific tax laws and general tax laws. State specific tax laws are contained in the following sections of the Louisiana Code — LAC 7102-2. Taxable Property of Louisiana (a) Each person who is in the taxable capacity for any year shall be taxable in each year by the amount of the gross income which he or she may receive in the taxable year under the provisions of the law of the State of Louisiana except to the extent that that income is excluded, modified, or adjusted to a lower rate by provisions of this Act. Louisiana Tax Code (LAC) 7102-2.1. State's Liability for Taxes Exempted or Reduced; Persons Receiving an Exemption (1) No person shall be required to file under any provision of this Act or any law of this State or be liable for any tax except in compliance with the provisions of this Act, in which cases any tax not so required is a tax of the State of Louisiana, with respect to the taxes which such person shall have to pay to the State of Louisiana under this Act. (a) The State of Louisiana is hereby authorized and empowered to require all persons to file annual tax returns and collect, in addition to such other sums and penalties which it deems necessary and proper, an amount equal to all taxes paid or assessed in the fiscal year.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 1040 2025 online Baton Rouge Louisiana, keep away from glitches and furnish it inside a timely method:

How to complete a 1040 2025 online Baton Rouge Louisiana?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 1040 2025 online Baton Rouge Louisiana aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 1040 2025 online Baton Rouge Louisiana from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.