Award-winning PDF software

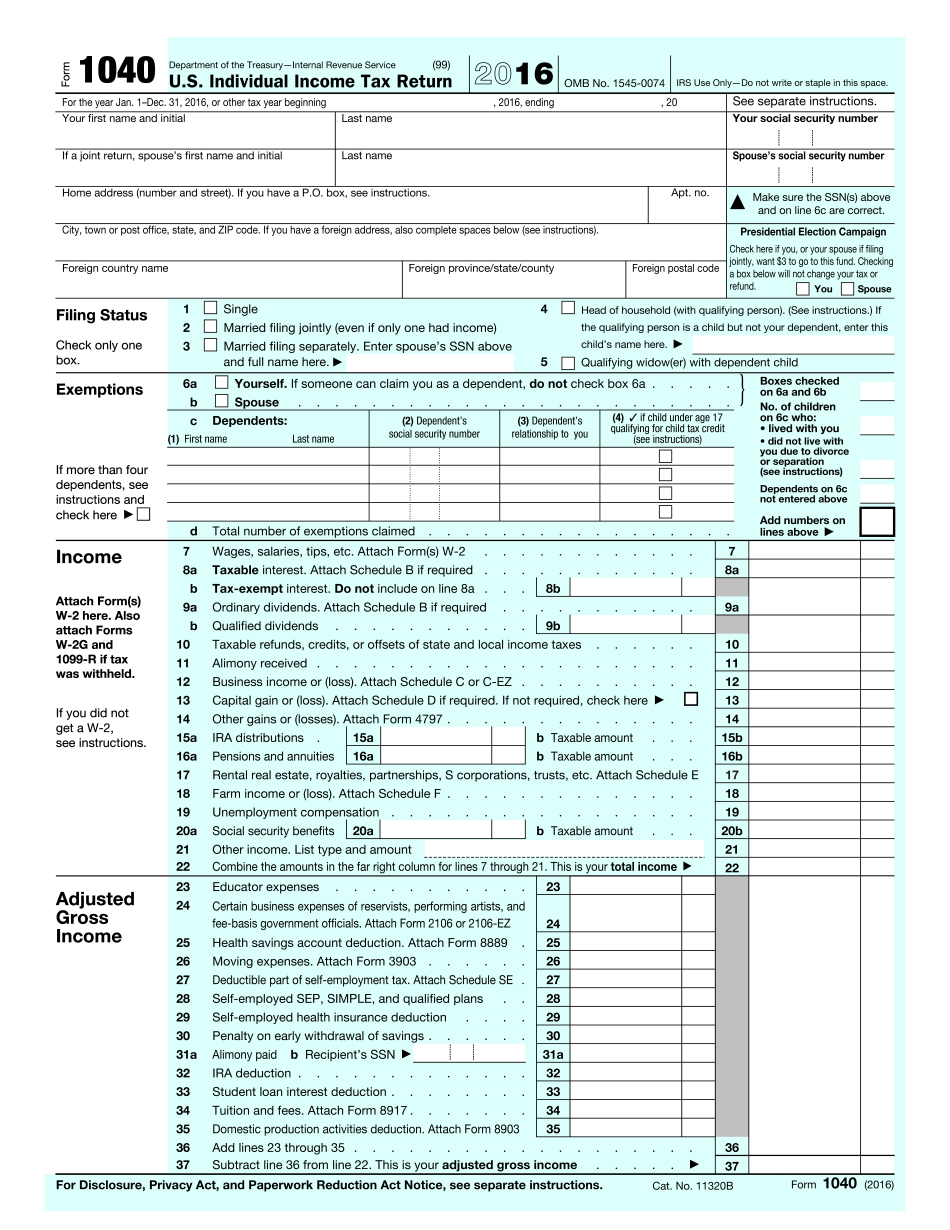

IRS 1040 2025 for Orlando Florida: What You Should Know

IRS and the Public Interest News Release: IRS to Issue a Special Alert Notifying Taxpayers of Proposed Changes to the Tax-Filing Process IRS Commissioner and Comptroller Announce New Ways to Pay the IRS: The IRS is issuing a new announcement today of three new ways to pay the Federal Tax Liability for Small Businesses and Start-up Firms. Learn more about the ways they can make voluntary contributions to the IRS, and make payments to the IRS electronically with Payroll Deductions, or at certain small businesses and start-up firms to pay the IRS as part of a new tax reform framework. IRS Grants to Help State and Local Governments Reimburse the Federal Government for Property, Water, and Sewer Projects Sept 27, 2025 — The IRS today announced five more grants awarded under the Economic Growth and Tax Relief Reconciliation Act of 2025 (EXTRA) to states throughout the United States for tax and infrastructure-related projects. The grants funded by the IRS will cover projects totaling a total of 3.1 billion. IRS and the Public Interest News Release: IRS Issues Announcement of New Ways to Make Payments IRS and the Public Interest News Release: Taxpayers May Save Money on their Tax Refund by Using the IRS Electronic Payment Service IRS announces a new online payment option for filing tax returns — The IRS today announced a new online payment option for taxpayers to make payments electronically — a service already available to small business owners, professional tax preparers and others. This payment option is offered to people with an IRS service-related account who want a secure online method to make payments to the IRS. IRS Announces New Tax Liability Information Technology (IT) Requirements for Small Businesses and Start-up Firms Apr 30, 2025 — Effective May 13, 2018, the IRS will begin requiring certain new small business and startup firms, as defined in the Small Business/Self-Employed Provision (SBS) of EO Tax Regulations, to meet new technology-specific requirements under the IT-Related Requirement (IR-R) of the Small Business/Start-Up (SBS) Provisions of EO Tax Regulations. The new requirements will also apply to any company (which does not have an existing, certified SBS) that files its first tax return in 2025 or later.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 1040 2025 for Orlando Florida, keep away from glitches and furnish it inside a timely method:

How to complete a 1040 2025 for Orlando Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 1040 2025 for Orlando Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 1040 2025 for Orlando Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.