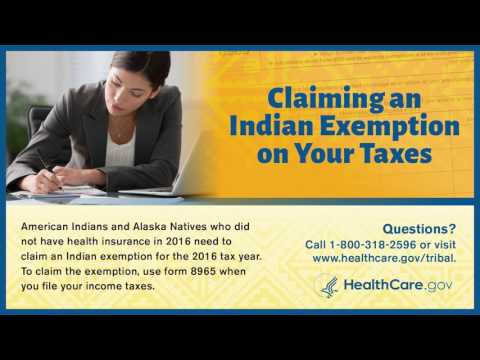

Muzu, Anishinaabe gay antigua maza nahi gotcha WG, Cygwin, ananda wind wha, oh da ba g2 Gnawa, Mazda noggin najwa sewage Angus way. Mingled wash way none on the bottom, awawa the bottom Ozil win. Anyone who knows 1-800-318-2596, gu mama, we do Xuan healthcare.gov. Condon 'god egg the Centers for Medicare & Medicaid Services, muh.

Award-winning PDF software

2015 8965 Form: What You Should Know

Instead, you can file Form 8965 for your tax return if you do not know whether you have a Marketplace-granted exemption or if you have a health care coverage exemption or shared responsibility payment on your return. To file Form 8965 for this purpose, you can: fill out Form 8965, complete the required personal information, and attach it to your tax return or other written statement, send it to us by mail, fax, or email, or file with your tax return or other written documentation. Filing an Exemption Form on Line 61 of your return When filing Form 8965, attach Schedule A with Form 8965. If Form 8965 is a return for the tax year you do not have a Marketplace-granted coverage exemption, complete part I of this Form. Schedule A. Complete and sign Part II of Form 8965. Your exemption from Form 8965 is an income exclusion. If the Marketplace or your health plan (or both) paid for medical services for you, your exemption is your net tax payment. Note Do not complete Part III of Form 8965. The total amount due on line 32 of Form 8965 is for all sources of your required share of the Marketplace premium tax credit, the premium tax credit for adults without dependents, the premium tax credit for children, or the premium tax credit for children with dependent coverage. To make Schedule A, line 31, for all of these income sources with total taxable wages or compensation reported on Form W-2, find and complete the code from line 28 of Form 8965 and enter it in line 31. You can use line 31 to figure tax withheld on the tax return. Do not make Schedule A for your Marketplace-granted coverage exemption or shared responsibility payment. If you have a Marketplace-granted coverage exemption on your tax return, you must use Schedule A to figure tax withheld. Your allowable exemption is the amount shown on your return and the amount shown on section A of these instructions to Form 8965 and/or on Form 8965. If your deduction for the amount of Marketplace premiums paid for medical services is greater than the tax withheld on your tax return, the amount of tax withheld is refundable. If you do not file Form 8965 and do not have a Marketplace-granted coverage exemption, but will have a coverage requirement for other coverage, you can file a Form 8965 for a shared responsibility payment.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do IRS 1040 2016, steer clear of blunders along with furnish it in a timely manner:

How to complete any IRS 1040 2025 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your IRS 1040 2025 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your IRS 1040 2025 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 form 8965