Award-winning PDF software

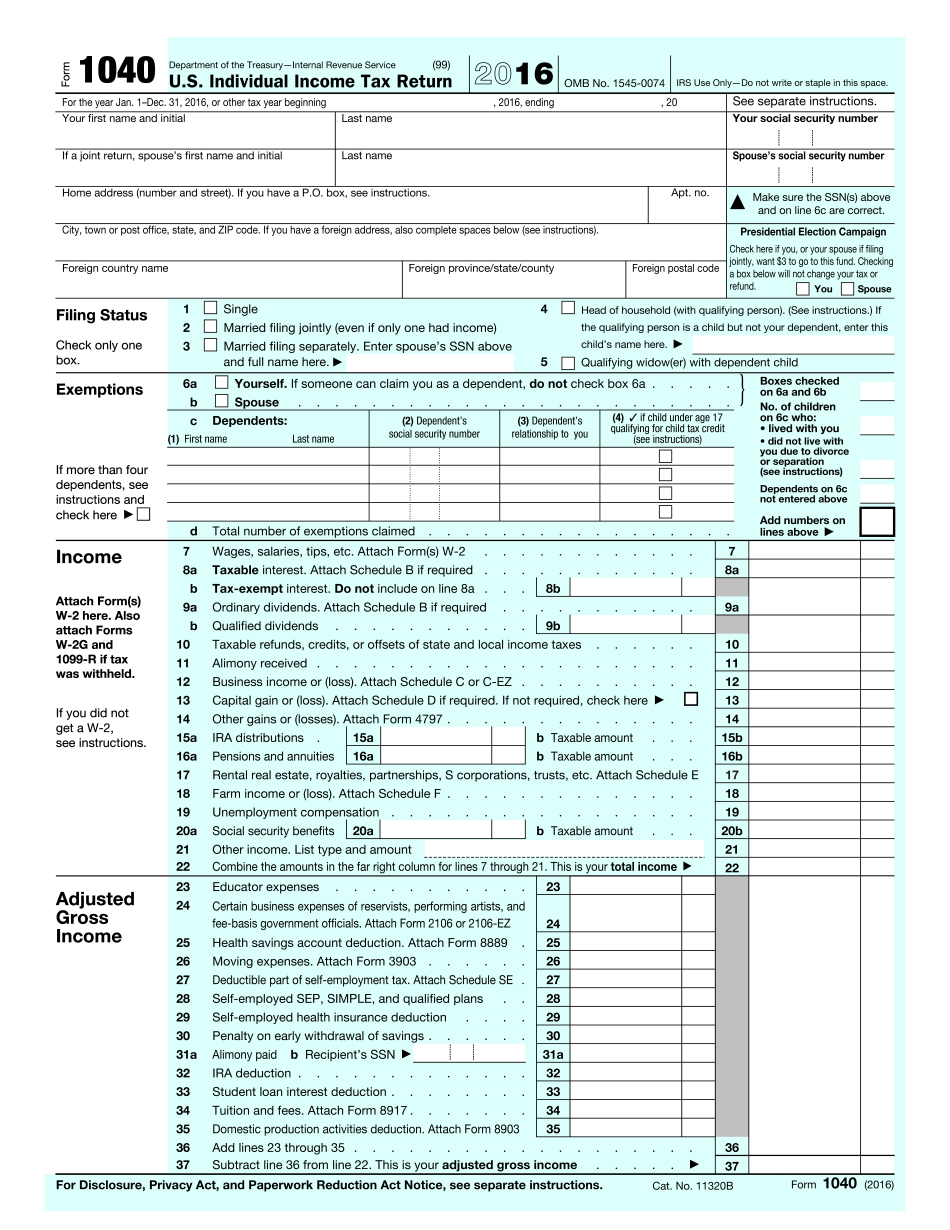

2016 tax tables Form: What You Should Know

If you already made such a claim, and it was denied, complete one of the following forms (you must have income from sources within the United States before claiming the housing credit): T2133, T2131, T2310 (a), T2310a or T2310b, or T2310c. A credit for eligible home improvements must be claimed. If the amount of the claimed low‑income housing credit is below the maximum, attach a statement to the application for eligibility certifying the amount of the amount claimed to be 1,000 or less. If you must claim a housing allowance to show that you have sufficient income to support your family, and if you need more than one form of assistance, you may qualify for one or more of the credits. To find out if this is possible or appropriate for you, visit any Department of Community Affairs office or call one of your local agencies in the Department of Community Affairs for assistance in calculating available housing assistance that may be available to you. This is very important!!! You must claim the credit for the home purchase to qualify for the reduction on your 2025 tax bill! 2 Tax Rates Form W‑7; if no Form W‑7, fill out W‑8; if W‑8, complete the required information for Form 1040, Line 1, and then complete the appropriate boxes for Line 2 through Line 12. For purposes of this publication, the following tables do not apply, but Form 1040EZ does. W‑7. Individual tax return for married filing jointly, and individual tax returns for individuals filing a Joint Return, if the combined gross income of the taxable individuals in a married filing jointly returns to less than 77,000 for the year, or 53,000 for each individual. Form W-8. Married filing separately, and individual tax returns for individuals filing a Joint Return, if the gross income of the taxable individuals in a married filing separately returns to less than 75,000 for the year, or 47,000 for each individual. Form 1041. Annual Income Tax Return for Individuals. Form 1040. Married filing separate joint returns for the year. Form 1045, Election to Itemize Deduction for Taxable Income. 1040EZ. Deduction for Qualified Green Energy Programs. This is very important!!! You must claim the credit for the home purchase to qualify for the reduction on your 2025 tax bill! 2 tax tables 2025 tax tables.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do IRS 1040 2016, steer clear of blunders along with furnish it in a timely manner:

How to complete any IRS 1040 2025 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your IRS 1040 2025 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your IRS 1040 2025 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.