Hello again and welcome back to our course on Project 2016. In this section, we're going to start looking at scheduling. As part of this, we have a couple of fundamental things to do to our plan in readiness for actually coming up with a realistic schedule for the wedding. The first thing I want to talk about is the difference between manual scheduling and automatic scheduling. And as part of doing that, I want to explain something about scheduling in Project 2016. If you wanted to take a plan such as this one and schedule it manually, there would be nothing to stop you. Now, what I mean by scheduling it manually is that you choose exactly which task starts on which date. You check that you've got the time to do it, that the resources are available, and that your constraints and deadlines are met. So, you can pretty much handcraft the whole schedule. In some situations, you may have projects where that's exactly what you decide to do. But with a large project, with a lot of resources and many constraints, dependencies, etc., that would be a very big job. It will probably take you quite a lot of time to maintain that schedule, particularly if there is a lot of change involved. And particularly if, as the project starts, things start, shall we say, not going according to plan. Largely speaking, one of the main reasons that people use Project 2016 is to automate the scheduling. Now, of course, there are many other reasons to use Project 2016. But the automatic side of scheduling is one of the most significant ones. And it's the one that we're going to be concentrating on quite a bit over the coming sections. So, my fundamental assumption about the wedding plan and indeed about the...

Award-winning PDF software

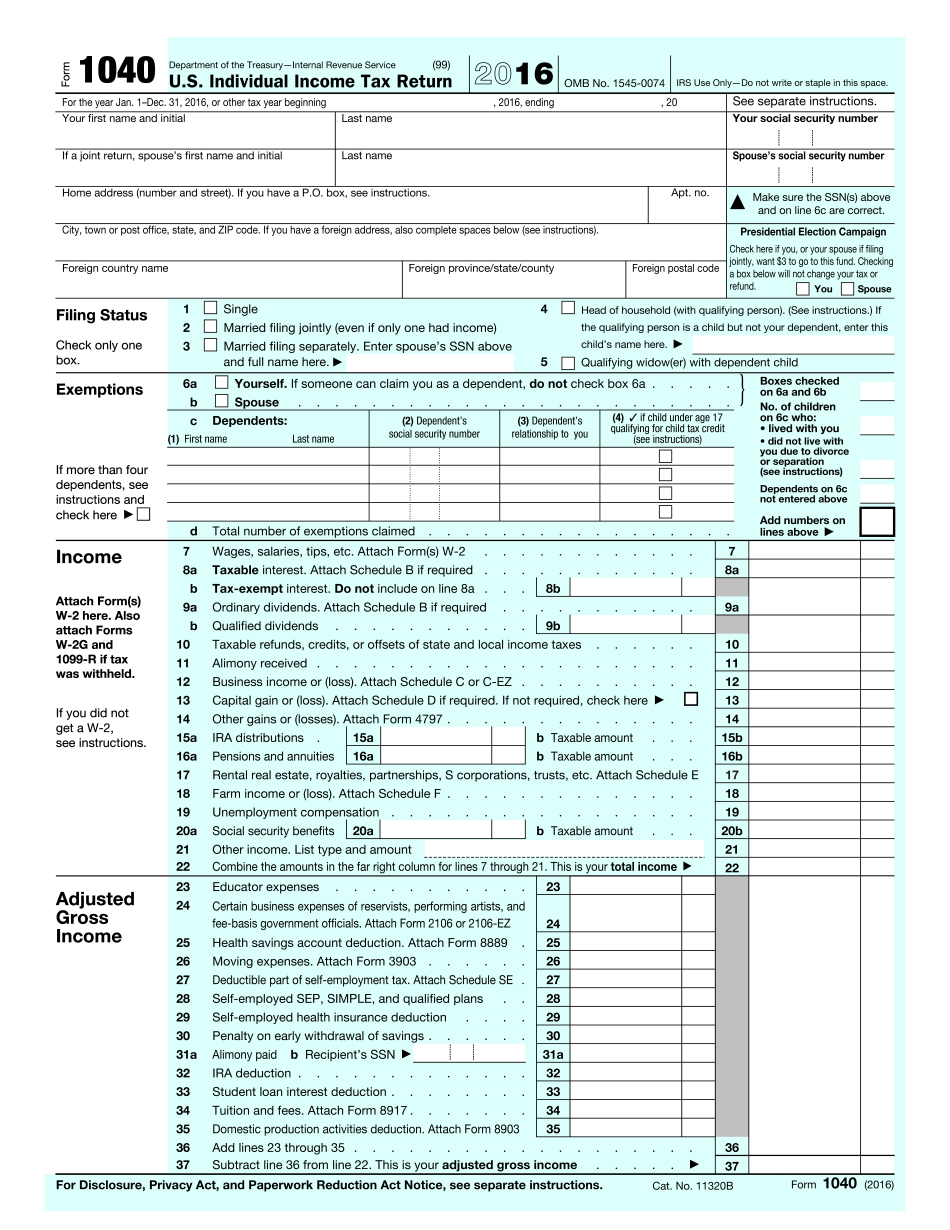

2016 schedule a Form: What You Should Know

Your schedule allows you to list how much you receive as a tax deduction from work for each of the past three years. Do you need a paper copy of the form? Yes. A paper copy of Form 1040 includes a work sheet that gives you information on your federal income tax. Do you need to fill out the work sheet? Yes. You must figure the amount you received as a tax deduction for the past three years. To file with Form 1040, use Form 1040. This is the Schedule A. The work sheet gives you information about your employment income in 2015. If you don't already have a work sheet, you may need to download and print one here. 2016, page 7, of 2025 Schedule A — Form 1040 (Schedule A). See work sheet for this page here. Attach to Form 1040. Note: You do not have to submit this work sheet to your employer. Your federal income tax will already be reflected on Form 1040. Feb 20, 2025 — List income from employment in your column of column 1. Do not enter in your column of column 2, any income from wages, salaries, or bonuses for this year. Column 1: Column 2: Column 3. Column 4: Income from business activities, from rental activities, and from any other source (other than a personal exemption). Line 5: Enter any other income source. Line 5 includes taxable income not shown in column 1. Line 5 does not include items from the following categories, except as listed in the column that follows. You do not have to submit this line. Line 6: All other income (line 7 in 2016), and line 16 of the worksheet. Note: The worksheets in this handout are the same as the 2025 Forms 1040, except that the current column no longer includes line 6. The current form is available here. Dec 7, 2025 — Schedule A is a mandatory itemized deduction form that must be filed during the calendar year. Do you need a paper copy of this form? If your tax return for 2025 will be filed electronically, you may be able to file a paper return. Electronic filing requires additional forms and instructions that are provided to you. Do you get these forms and instructions by phone or mail? For details about your options, visit and click on Forms and Publications. You can also complete Line 14 of the worksheet to see what income types may be reported for 2017.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do IRS 1040 2016, steer clear of blunders along with furnish it in a timely manner:

How to complete any IRS 1040 2025 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your IRS 1040 2025 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your IRS 1040 2025 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 schedule a